The goals of LEED (Leadership in Energy and Environmental Design) target climate change, resource management, biodiversity, and quality of life. To get a home project certified, the most important note to remember is that you must engage and register your project before designing or building it. Large parts of the LEED certification focus on site selection, so aiming for a certification after construction has commenced will not work. The LEED process is rigorous, and is not for those with shallow pockets.

Prerequisites

Building must be on a “permanent location on existing land.” For example, mobile homes are not eligible for LEED. Prefabricated homes (that are gaining in popularity) are eligible, as long as they are part of a permanent installation. The LEED project seeking certification should include the entire building and the total scope of work, not only the building itself. This includes hardscapes like driveways, bushes, trees, and other landscaping. In addition, local building codes must define the structure as a “dwelling unit,” in order to be eligible for a LEED housing certification. The international residential code stipulates that a dwelling unit must include “permanent provisions for living, sleeping, eating, cooking, and sanitation.”

LEED Certification Levels

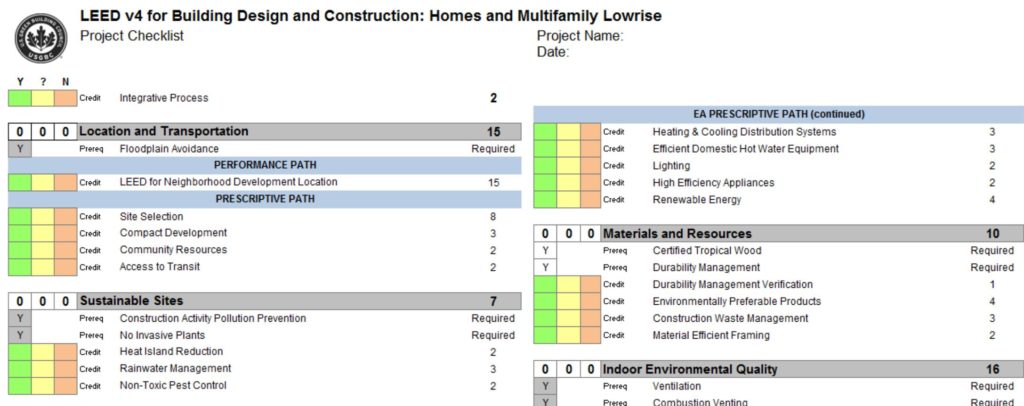

Which LEED certification level your project receives is based on an often-debated point system. For LEED Homes, the maximum point potential is 110. The chart below shows the possible points by category for homes. Most categories have a points-for-performance path in

addition to the more standard path.

| LEED v4 Home Categories |

Possible Points |

| Integrative Process |

2 |

| Location and Transportation |

15 |

| Sustainable Sites |

7 |

| Water Efficiency |

12 |

| Energy and Atmosphere |

38 |

| Materials and Resources |

10 |

| Indoor Environmental Quality |

16 |

| Innovation |

6 |

| Regional Priority |

4 |

| TOTAL: |

110 |

The Points

I recommend approaching the LEED point system by reviewing each of the 110 points (including the required pre-requisites that do not award points values) and assign a dollar value to each. This method will help determine both a home design and the LEED certification level target. Once the home is built and ready for review, the $300 cost to pursue LEED certification goes to the US Green Building Council in order to book an onsite certification survey.

Many of the points are awards based on some kind of technical, sliding scale. For example, reducing water usage by 10% is one point, and 20% is two points, etc. I selected a handful of “easy” points below and summarized each category. Achieving all 14+ “easy” points below will put your home project well on its way to reach 40 points for a LEED certification!

Sustainable Sites – This category focuses on the site environment, and supporting the natural ecosystem of the site.

- 1-2 points for locating trees or non-absorptive materials to cover >50% of roofs or other hardscapes surfaces.

- ½ point for designing landscape features to provide a minimum 18-inch (450 millimeter) space between the exterior wall and any plantings.

Water Efficiency – This section rewards points for efficiencies in indoor and outdoor water use, and water metering and management.

- 1 point for the average toilet flush volume across all toilets not exceeding 1.1 gallons (4.1 liters). Each toilet fixture and fitting must be WaterSense labeled.

- 1 point for all clothes washers to be energy star qualified (or performance equivalent outside the US).

- 1-4 points for reducing grass areas and increasing native plantings, as percentage of total landscape area.

Energy and Atmosphere – The bulk of this section (18 of the 38 points) focuses on the degree to which energy efficiency can be improved compared to a baseline standard. More efficiency awards more LEED points.

Materials and Resources – This category primarily addresses building materials, including transport and disposal.

Indoor Environmental Quality – This section focuses on air quality, including thermal, visual, and acoustic comfort. This section is one of the most health-conscious parts of the LEED certification.

- 1 point for a control for the use of the local exhaust fan in full bathrooms, such as an auto-off timer or an occupancy sensor.

- ½ point for including a non-carpeted mudroom

- ½ point for sealing all permanent ducts and vents after installation to minimize contamination from construction. Remove seals after all phases of construction are completed.

- 1 point for multiple thermostat zones for both heating and cooling. Single-family houses with less than 800 square automatically meet the requirements of this credit.

- 2 points for NOT installing any fireplaces or woodstoves. These can still be installed for 1 point if they are EPA-qualified.

Innovation – The LEED authors largely leave this section open to accommodate future innovations in building design and construction.

- 1 point for having at least one principal participant of the project team with a LEED Accredited Professional (AP) certification and a specialty appropriate for the project.

Regional Priority – This section awards points to specialized priorities based on region. The point values vary by region.

Points spreadsheet sample from US Green Building Council

A Common Pitfall

According to a Philadelphia architect who I spoke with, a common pitfall in LEED certifications is shortcuts in construction. Builders may substitute less green materials – say a ceramic floor instead of something more sustainable – on their own accord. In defense of the builder, such a shortcut may be more cost effective and faster to install. Unfortunately, removing the error and installing what was originally needed for LEED points generates even more waste. To avoid this, hiring a LEED-certified builder is strongly recommended.

Resale Value & Conclusion

As of this writing, hard evidence for LEED certifications yielding higher selling prices does not exist. However, several studies and articles support a correlation with energy efficiency improvements to a home and a higher selling price. This makes sense because both LEED and green homes have lower utility costs and are healthier for occupants. Extremely green homes such as those with LEED certifications may sell for as much of a ~30% premium, while homes with moderate energy efficient accommodations and certifications may sell for a ~10% premium. Data is spotty, since US property markets vary widely, and finding both a LEED home and a comparable non-LEED home is difficult. Nonetheless, although the LEED brand may still be new to some home buyers, the benefits of greening a home (that LEED requires) appears to almost always be a smart investment.

For more information about the LEED certification for homes, here’s a link to the US Green Building Council: http://www.usgbc.org/credits/homes/v4